This is tutorial #11 in the Drupal Commerce tutorial series. In the previous article, we showed you how to add VAT tax for your site.

In this article, we will show you how to add Sales Tax to the billed amount. Sales tax is a tax collected from the buyer at point of purchase. It is usually paid to a governing body by the retail outlet.

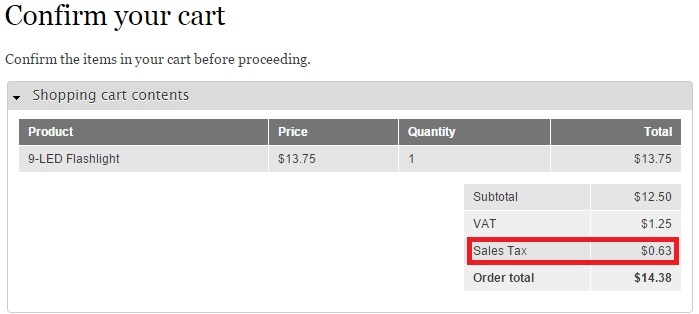

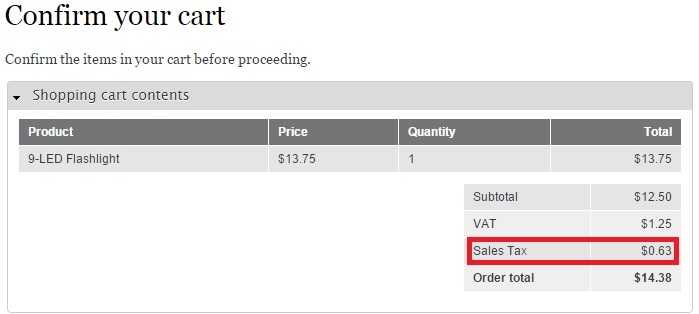

By the end of this article, you will be able to feature Sales Tax as part of the bill as shown below:

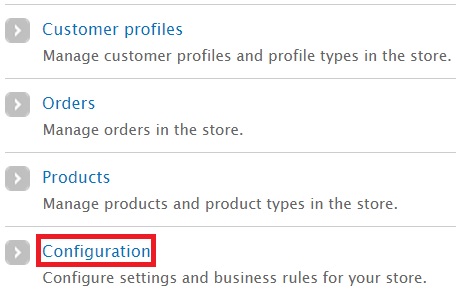

The procedure to configure Sales Tax is the same as in the previous article. Click "Store" -> "Configuration":

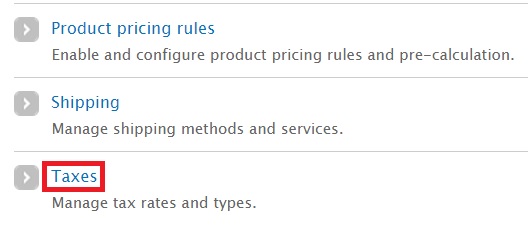

Click “Taxes”:

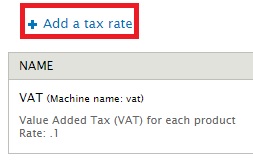

Click “Add a tax rate”. You will notice the VAT tax created earlier:

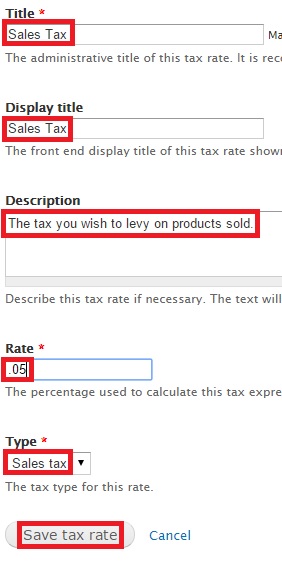

In the new page, fill in tax details just you like did for VAT tax:

· Title: I have provided “Sales Tax”.

· Display title: This field is not mandatory. I have provided “Sales Tax”.

· Description: I have provided a brief description about Sales Tax here

· Rate: How much do you wish to charge as Sales Tax? Provide the value in decimal format. I want to impose a tax of 5%. So I typed in .05..

· Type: I chose “Sales Tax” from the dropdown.

Click “Save tax rate”:

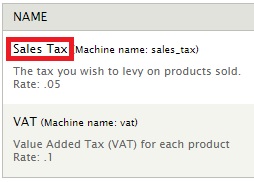

The newly created tax is saved:

Let’s now check out a product and confirm whether Sales Tax reflects in the bill:

The Sales Tax will be reflected when you are asked to confirm your cart:

You can choose to keep either Sales Tax or VAT. Feel free to delete the tax that’s not required for your country.